Both small and large tax

savings lie in waiting for us to grasp. Some are handouts from the federal and

provincial governments and others are strategies we have to put into

practise. Unfortunately, taxes are a way

of life for Canadians. Our tax dollars help to pay for government programs and services. On the flip side, we have

financial goals and dreams, too, just like the government has theirs. Every cent we can save for ours is

invaluable.

As always, it’s not a surprise

to see the tax brackets modestly increase each year to adjust for inflation. But a much-welcomed surprise and an unusual adjustment is to the Basic Personal Amount (BPA)--what

I refer to as our tax-free zone. For 2020, the proposed Basic Personal Amount

is $13,229 whereby personal income tax does not apply on these first dollars of

income. The bonus is these small tax-free gifts will continue in the

forthcoming years. The Federal government’s intention is to increase the BPA over

four years until the amount reaches $15,000 in 2023.

This year Canadians with

income above this minimum threshold will hardly notice the difference. The tax

savings will equate to $174 ($13,229-$12,069)x15%) when you compare the Basic

Personal Amount in 2019 of $12,069 to the newly proposed $13,229. The increased savings will come with time.

The priceless suggestion is

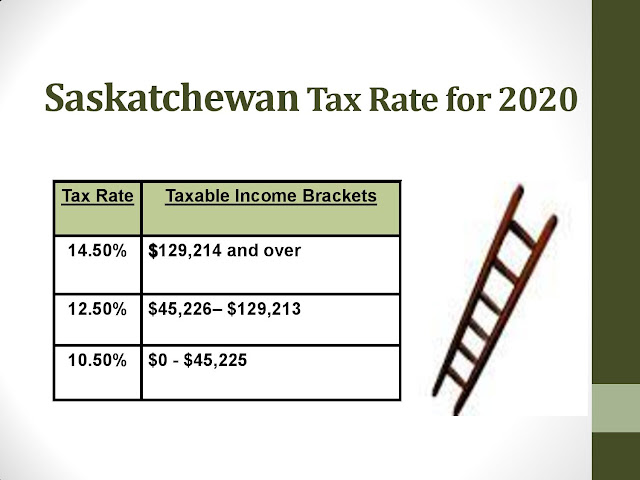

to make time to assess and analyze where your income will land, both on the

federal and provincial ladders. This practice is most beneficial as one year

ends and another begins. The tax brackets help to pinpoint your marginal tax rates. If you are conscious of saving for specific

goals, I always encourage looking at the amount of income tax you have paid by

year-end.

Your last pay statement of

the tax year or T4 information slip provides valuable information. Seeing firsthand the amount of income tax

deducted from your gross income may shock you into action and cause you to plan

different strategies to keep some of your hard-earned dollars in your pockets.

During your working career,

a useful and practical strategy is contributing money to an RRSP (Registered

Retirement Savings Plan). This is

especially applicable when your income falls in the second tax bracket and higher. In the

diagrams below, the ladder draws your attention to the fact that as your income

increases so does your marginal tax rate.

All Canadians start at the bottom.

The tax savings, derived

with deposits to an RRSP, generates a tax refund for other financial

goals. This ripple effect creates a dual

bonus. As you save for your retirement,

you have additional cash to pay down credit cards.

Here’s a basic example:

All year, you have

diligently saved $100 each week so by the end of the year, you have tucked away

$5,200 in a daily savings account. Now

you are contemplating your goals for the year.

You stare at your retirement savings and credit card statements and

wonder what to do.

One possible strategy is

depositing your savings into an RRSP investment vehicle to reduce your taxable

income for the year. Once your tax

return is filed, you receive a tax refund for your top-up contribution. I choose to think of this as having your cake

and eating it too.

The math tells us. Your annual income is $55,000 (which falls in the second tax bracket). A contribution of $5,200 deposited to an RRSP refunds $1,066 ($5,200 x 20.5%). Now the refund can be applied towards your

credit card. The dual purpose is you

have saved for your retirement and reduced your debt.

This quick glance looked

only at the federal side of taxable income and tax credits. Our provincial

governments also offer different packages of tax rates and credits. The tax savings exist on two levels. The tax side to wise financial planning can

be complicated. With an array of tax

planning incentives and strategies, you may need some assistance to decipher

which apply to your family and you. A

new year always brings new tax changes to help us. Ensure you make the best of a taxing situation

with sound financial advice.

No comments:

Post a Comment